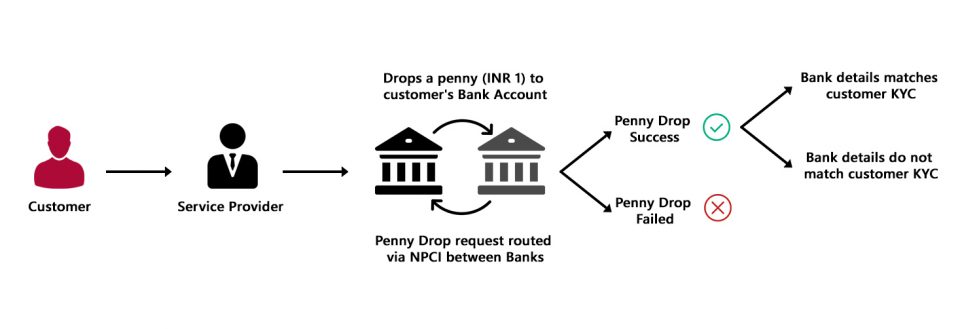

Bank Account verification is a method utilized to validate bank accounts effectively. It entails depositing a nominal amount, typically INR 1, into the designated bank account. For instance, during the onboarding process of a new vendor, a critical requirement is to verify the vendor's bank account details. This verification is imperative to ensure the authenticity of the bank account and to avert potential payment transfer complications for both the business entity and the vendor.

The Bank Account verification process serves a multifaceted purpose. It not only authenticates the customer's bank account but also confirms its operational status. Furthermore, it aids in ascertaining whether the provided account details indeed belong to the intended vendor.

The primary objectives of businesses employing bank account verification for their customers are:

Utilizing Bank Account verification, businesses can accurately ascertain the authenticity of their customers' bank accounts before initiating transactions. This approach ensures that the bank account belongs to the same customer who is registering for their services.

Bank Account verification is a versatile method employed by businesses of all sizes for validating customer bank accounts. It finds application in various sectors, including:

1. User Input:- The user provides their bank account number and IFSC.

2. API Initiation: Paykosh initiates a Bank Account API request by depositing INR 1 into the customer's bank account.

Response: The API returns the final status of the request.

- Success, along with a reference number and beneficiary name if the bank account is valid.

- Failure, with details of the reason for the verification failure.

Additional Verification: Businesses can further verify customer details by cross-referencing the beneficiary name returned in the response with the name provided in the application.

The Bank Account verification method, involving the deposit of a nominal amount into the user's bank account, allows companies to confirm the recipient bank's authenticity and user information. This straightforward process helps identify errors before significant sums of money are transferred.

Additionally, Bank Account verification plays a pivotal role in preventing fraudulent financial transactions, particularly when dealing with fictitious individuals attempting to defraud the company. This preventive measure is crucial for minimizing potential losses. Companies planning to execute recurring money transfers via eMandates should adhere to the Bank Account bank account verification process to safeguard against unnecessary financial liabilities.

Incorporating the Bank Account technique into the KYC customer onboarding process is a critical step that streamlines bank account verification, benefiting both the company and its customers.